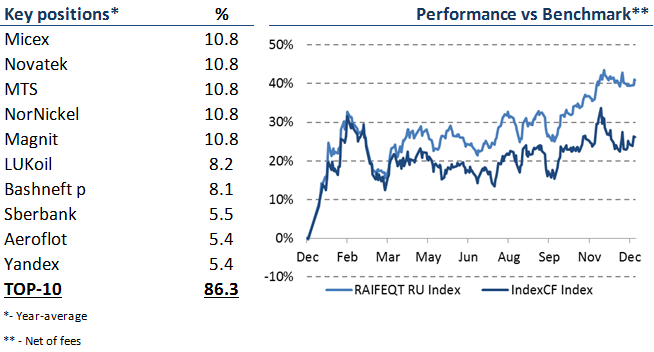

The perfect year in ruble terms thanks for huge national currency depreciation due oil price fall. Continue to hold equal-weight strategy and focusing on 8-10 best names on the market. In 2Q I started to hedge portfolio performance through Direxion Daily Russia Bear 3X ETF. It was very useful especially in the 4Q when oil prices sided significantly.

I said goodbye to Aeroflot after State tried put vast Transaero debt on company balance through merger.

By the year end I switched from Bashneft preferred shares to common because of relatively small price spread — only about 10%.

All data based on official disclosure informafion — Bloomberg and Asset Management Company Reportings:

Raiffeisen Equties Value of assets Report — 1Q 2015 (download)

Raiffeisen Equties Value of assets Report — 2Q 2015 (download)

Raiffeisen Equties Value of assets Report — 3Q 2015 (download)

Raiffeisen Equties Value of assets Report — 4Q 2015 (download)