In the very beginning of the year Trump-rally was continued but with a quick stop – people started to realize that new US president cannot fix geopolitical tensions with Russia and oil prices falling sharply after OPEC deal failed to manage global oil stock lower.

Russian economy showed more and more clear signs of improvement, ruble moved higher against greenback and inflation came down.

In June OPEC and Russian reached new agreement to keep their oil output level in line with the previous pact to provoke future destocking on oil market. After couple of months of non-trending moves oil started to recover very quick and surprisingly reached level of 60 per barrel of Brent by the year end.

It was the main driver on the Russian market in the 2H2017 that help equities move higher but in ruble terms by the end of 2017 most names finished in red zone in ruble terms.

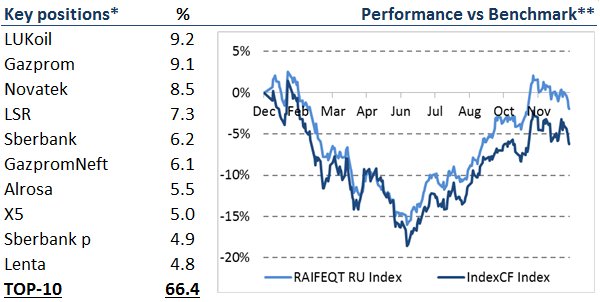

Stock-wise by the start of 3Q I started to use new portfolio constructions principles. First is industry-wise approach: sectors allocations versus benchmark. Next is stock selection under sector limits. Maximum weight for single stock is 10% and minimum weight for single stock is 5%.

At the end of the year, my portfolio had 14 names with top positions in retailer X5, fast-growing TCS bank and GazpromNeft.

All data based on official disclosure informafion — Bloomberg and Asset Management Company Reportings:

Raiffeisen Equties Value of assets Report — 1Q 2017 (download)

Raiffeisen Equties Value of assets Report — 2Q 2017 (download)

Raiffeisen Equties Value of assets Report — 3Q 2017 (download)

Raiffeisen Equties Value of assets Report — 4Q 2017 (download)