Another tought year for russian market — sanctions noise in April and July and overall riks-off on emegigng markets were created negative sentiment. The only one supporting factor was oil price thanks for right OPEC+ policy and worries about oil export ban for Iran in case of US sanctions.

I started the year with resonable structure of portfolio with about one-third in oil names and about 50% in domestic plays.

Moving into the year with massive ruble devaluation and very nice level of oil prices i started to increase exporters share because of strong earingns momentum.

New round of sanctions forced me to exclude domestic plays becasue of overal weak macro data — i sold Aeroflot, TCS and X5 leaving only MDMG pure long-term and very iiliquid play.

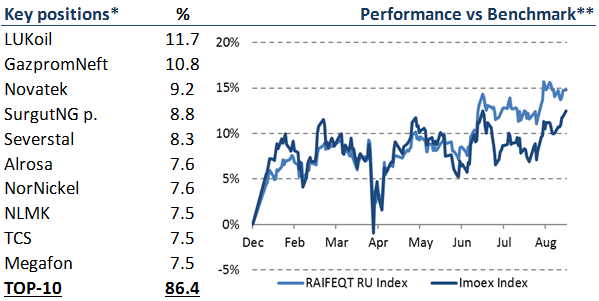

At the end of the August, my portfolio had 12 names with top positions in oil space — LUKoil, GazpromNeft, NOVATEK.

All data based on official disclosure informafion – Bloomberg and Asset Management Company Reportings:

Raiffeisen Equties Value of assets Report – 1Q 2018 (download)

Raiffeisen Equties Value of assets Report – 2Q 2018 (download)