RTS : 883 | Brent spot: 40.5 | RUB/USD : 67.50

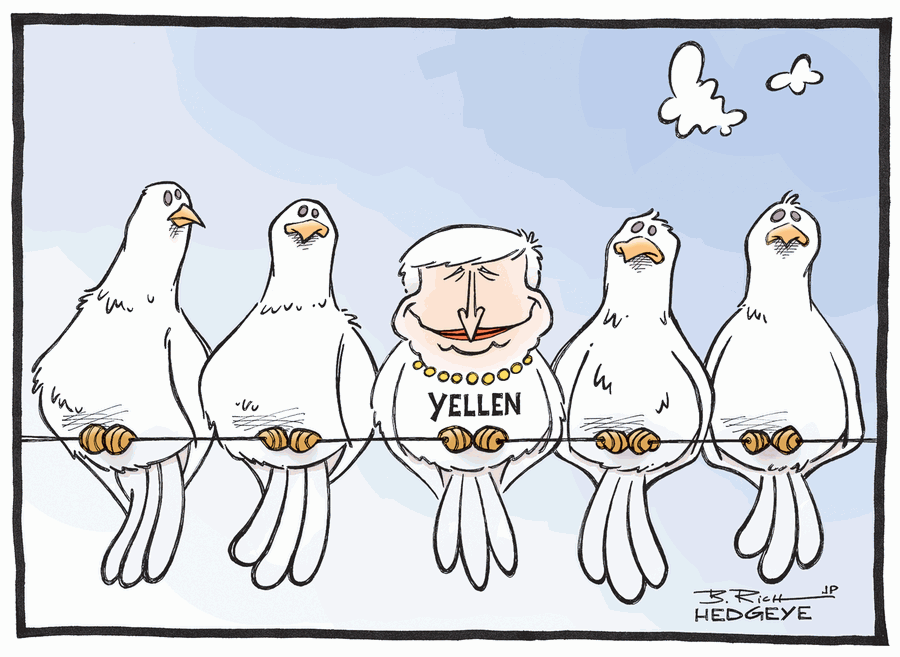

Last week was completely great for equities, especially emerging markets – dovish FED statement provided additional risk on turn. As the result global equities gained about 1.5% for last five trading sessions as well as EM printed +5% and turning back to the positive territory YTD. Russia was the best performer – RTS added 6% thanks for oil prices topped $ 40 level.

Ruble was strong added about 4% and moved back below 70 for USD after oil prices continued shift higher – it was supportive for domestic stories first of all for Sberbank.

Big story of last week was steels: HRC prices risen sharply in last couple of weeks to $370 per ton level reacting to great spike in iron ore prices in China. Move was really helpful for Russian steels names – Severstal & NLMK. I think that last move is not a turnaround story and still look skeptically at steels.

In small caps segment I saw a lot of interest in Aeroflot – people still jump in the stock after solid results for 2015FY and in the light of future privatization.

RTS added more than 30% from early February and now looks completely overbought – I’m still think that market is ready for correction and recommend at least not to open new longs.