Market

September was generally flat month for the Russian equities in ruble terms – Micex index walking around 2000 points for a whole month while ruble appreciated by 3% on FED decision and surprising OPEC cut. In dollar terms market gained another 3% that brings YTD performance to solid 30% figure. Oil prices move closer to $50 per barrel mark on OPEC.

On the sector level September was a bad months for telecoms – people still scare about potential fines against MTS by US authorities of Uzbekistan case. On the other hand investors still have no clear view on implementation of anti-terrorist law. Both MTS and Megafon hugely underperformed against Micex.

All other sectors showed generally flat performance for the month. Undoubted leader for this year – Utilities failed to gain in market cap after impressive +75% YTD in ruble terms on the lack of news. But some stock showed good results again – Inter RAO gained another 10% for September (almost triple YTD). I think it linked to company road show last month in Europe & US and inclusion in Russian Market Vector Index (benchmark for biggest ETF on Russia).

Portfolio performance

In September portfolio unperformed Micex – Fund lost about 0.9% vs Index only +0.3%. In YTD terms Fund returned 15% against +12% of benchmark.

Only two out of my eight bets showed positive return for the month – Alrosa and Sberbank prefs. All other position was on the red side. I think that great performance of Alrosa was connected to excellent results for the first half of the year and prospects of nice dividends for the whole year.

Prospects

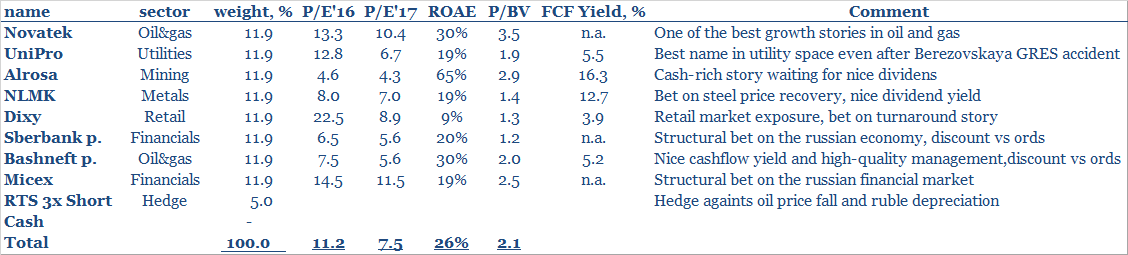

The whole portfolio is currently trading at a P/E multiplier of 11.0Х and 7.3Х for the current year and next year respectively.

I prefer to stick to the current portfolio structure, but am always looking for new ideas.