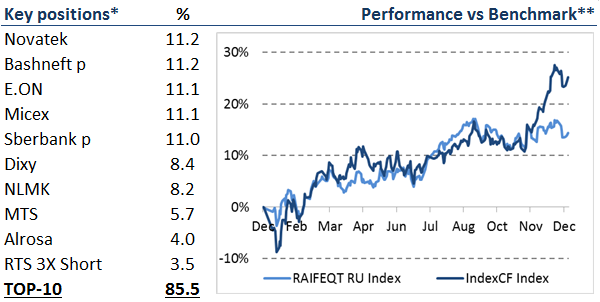

Completely difficult year for market and my portfolio too with some Happy-ending, unfortunately not for me. Market close in green zone especially in blue chips after Trump won president campaign in US ans investors started to bet on geopolitical normalization. Separately OPEC, Russia and some others countries reached agreement to cut oil output from the start of 2017 to rebalance global market . This news provided huge spike in oil prices which usually helping Russian equities move higher especially oil&gas names.

My portfolio performed well for the most part of the year except last two month – because of big exposition to second-tier non-energy names which not participated in Trump&Oil rally in November and especially in December.

Stock-wise, only big rebalance was switch in retailers from falling Magnit into Dixy. I was tuned constructively for this name as some turnaround story after management was replaced.

In the end of the year I bought LSR in my portfolio as structural bet on Russian residential market as ruble rates started to decline quickly.

All data based on official disclosure informafion — Bloomberg and Asset Management Company Reportings:

Raiffeisen Equties Value of assets Report — 1Q 2016 (download)

Raiffeisen Equties Value of assets Report — 2Q 2016 (download)

Raiffeisen Equties Value of assets Report — 3Q 2016 (download)

Raiffeisen Equties Value of assets Report — 4Q 2016 (download)