Market

In August Russian equities showed relatively good results versus global markets – RTS index added 2.4% while global stocks ended flat and emerging markets gained about 1%. The main source of outperformance was oil prices which has been resurrected after sharp fall in July. Ruble was strong and added about 1% against US dollar and ruble-denominated Micex Index gained about 1.4% for a month.

The best performing sector of the August (this is not surprise, hah) was Utilities again (+70% YTD in ruble terms!) – Industry index gained about 5%. Investors continue to picking up some liquid ideas in sector (Inter RAO, FSK EES, Rosseti, RusHydro) after good financial results for the 1H’16. I just want to note that in my opinion after adjustments for one-offs core results looks neutral so current rally is more speculative than fundamental.

My only position in sector UniPro lagged to sector again – company published 1H results and disclosed some assessments of Berezovskaya GRES accident. Total amount of repair cost was increased to 25 bln rubles and block will return to work only in 2018. I think that news is slightly negative but company still offers nice divided yield.

The worst performer of the month was Telcos – Antiterrorist law putting some pressure on mobiles. In investor’s view the worst case scenario law implementation means huge capex and zero free cash flow for a couple of years.

Portfolio performance

In August portfolio outperformed Micex – Fund added about 3.2% vs Index only +1.4%. In YTD terms Fund returned 16% against +12% of benchmark.

The best performers in last month was DIXY – company published positive results for the second quarter showing large improvements in margins . Good performance also was showed by MoEx, Novatek and Alrosa. In case of Alrosa I just stress that as usual in Russia some temporary decisions became permanent – in lack of ideas I prefer to hold this cash-rich name with hopes of vast dividends.

After July’s switch from MTS to Alrosa which given about 10% of relative outperformance in August I was in wait and see mode.

Prospects

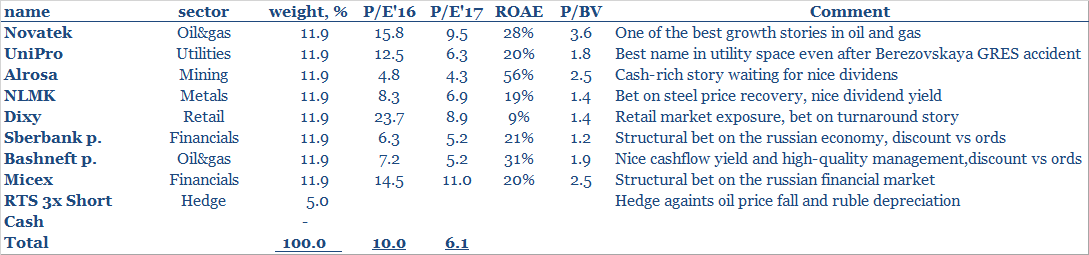

The whole portfolio is currently trading at a P/E multiplier of 10.0Х and 6.0Х for the current year and next year respectively.

I prefer to stick to the current portfolio structure, but am always looking for new ideas.