Market

Russian equities and ruble showed relative strength against sharp fall in oil prices – Brent declined through the month by 15% to the $ 40 per barrel while RTS lost less than 1%. Taking into account the weakening of ruble by 5% versus US Dollar Micex Index in ruble terms gained about 3% for the month.

The main theme for the global markets in July was expectation of further soft money policy by biggest Central Banks – it gave some support to risky assets like Emerging markets.

The best performing sector of the July (third month in a row!) was Utilities (just note that sector gained more than 60% YTD in ruble terms!) – industry index gained about 11%. In July investors interest shift from YTD leaders (InterRAO& FSK EES) to laggards – OGK2 gained about 25% while Rosseti added about 35% to the market value for the month (!). In the second case the main reason for sharp move was expectations of high dividend payments by the company after strong 1H results under RAS. But I think that probability of huge payment is relatively low and recommend to avoid such kind of stories.

I’m still waiting for value unlock in my sole bet in Utilities – UniPro (Former E.On Russia) – unfortunately stock underperformed against industry Index in July. By the end of August company will disclosure figures about Berezovskaya GRES repair cost and insurance coverage – I hope it will be a trigger for market to reassess investment case.

The worst performer of the month was Oil and Gas sector – State plan to modify tax system for the industry and the main outcome of this will be increase of the tax burden. The worst performer in sector was Surgutneftegas prefs – shares goes through ex-date with lavish dividends payments (14% yield). Now this case looks not so pretty because of large ruble appreciation YTD (about 10%) which destroy company profit for this year – so dividends for prefs for this year will be so small.

Portfolio performance

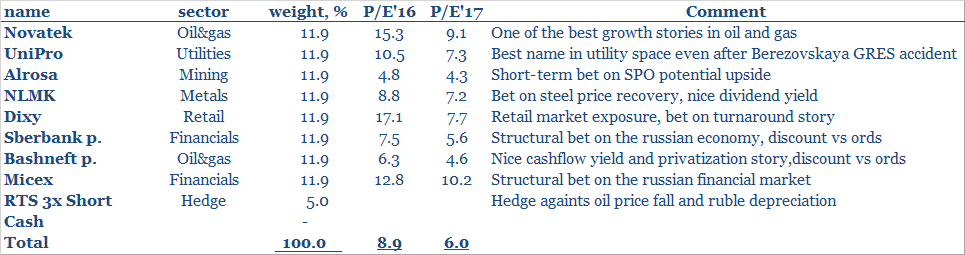

In July portfolio slightly outperformed against Micex – Fund added about 6% vs Index only +3%. In YTD terms Fund returned 11.0% against +10.5% of benchmark.

The best performers in last month was NLMK (thanks for rebound in prices for iron ore in China). Good performance also was showed by UniPro, Sberbank prefs and Dixy. In case of Dixy investors positively reacted on strong 1H operational results (sales grown by +20%). Next point will be financial results for the first six month –market have some fears about company profitability.

I had only one rebalance in my portfolio – I sold MTS and took Alrosa in general because of potential negative effect from antiterrorist law. I prefer to stay away from telecom sector for some time and waiting for further developments. Alrosa case is really clear – company have a big positive cash flow and will be distribute it via dividends in near future.

Prospects

The whole portfolio is currently trading at a P/E multiplier of 9.0Х and 6.0Х for the current year and next year respectively.

I prefer to stick to the current portfolio structure, but am always looking for new ideas.