Market

Despite of massive news flow June was the flattest month for Russian equities this year – Micex index lost less than 1% while dollar-denominated RTS gained about 3%. Oil prices stayed in narrow range $ 45-50 per barrel for all June after sharp rally in previous couple of month and ruble gained about 3% versus US Dollar. Brexit theme played a big role in global market movements but in currently looks like short-lived shock.

The best performing sector of the June was Utilities again (just note that sector gained 47% YTD in ruble terms!) – industry index gained about 8% thanks for rally in Inter RAO (+30%) and another great surge in FSK EES (+22%!). I still have a caution view on sector prospects after big run in some names (IRAO MCap +110% YTD while FSK +150%) and stick to my only utility name in portfolio – UniPro (company previously named E.ON Russia).

The worst performer of the month was Telecoms sector – antiterrorist modifications in law that passed by Duma and Upper House can potentially bring a vast negative effect on companies business because of large additional capex spending on data storage equipment.

I’m really anxious about MTS prospects because of this Law company value will be destroyed at least by half. On the other hand if President will put a veto on Law upside potential for stock is limited.

Portfolio performance

In June portfolio slightly underperformed against Micex – Fund lost about 1% vs Index lost less than 1%. In YTD terms Fund returned 5.5% against +7.5% of benchmark.

The best performers in last month was UniPro and Moscow Exchange (MOEX). In first case nice stock performance can be explained by relatively big dividend yield (around 7%) and approaching of the record date (1th of July). In second case the main source of outperformance was news that VEB has no plans to sell stake on the open market so no overhang on the secondary market in mid-term.

Prospects

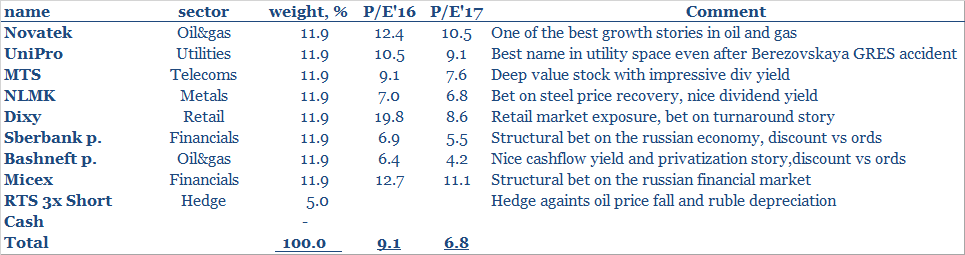

The whole portfolio is currently trading at a P/E multiplier of 9.0Х and 7.0Х for the current year and next year respectively.

I prefer to stick to the current portfolio structure, but am always looking for new ideas.